Re: tax rate overhaul

I've got few points for consideration;

Background: My dad is a CPA who owns his own business and does hundreds of tax returns per year.

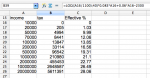

First our income tax system is based on tax brackets. This means that you only pay the brackets income tax rate on income above the threshold. As an example for tax year 2011 for a single filler the lower cut off for the 25% income tax bracket is $34,500. If you make $35,000 only $500 is taxed at 15% the rest is taxed at the rates of the lower income tax brackets. This means that if deductions, exemptions, etc ... are excluded there is never an incentive to make less money. If you make more money you will get to keep more money.

Can't say I really follow that complete sentence, but yes more money is always more money. At some point for very wealthy people who really don't need more money to improve their quality of life, if the marginal tax rate seems confiscatory, they will be less inclined to work more/harder.

Just like sin taxes are a disincentive to smoking or drinking, they can likewise disincentivize high income earners to not pursue marginal income. For the youngsters out there, we have experienced much higher marginal tax rates in the past, and hopefully learned out lessons, but once again we prove how short our memory is. Other countries like GB have also had their experience with high marginal rates, causing some high income artists to actually take up residence elsewhere. In the USA several state "millionaire taxes" have been discouraging for the states, as their millionaires moved to other states. This is happening now with businesses leaving California in droves. The bet by the federal government is that they won't chase businesses away from the US, while other regions of the world are already more attractive (for taxes, not the whole picture).

Second: As my Dad explains it, and I agree, there are at least 3 distinct reasons for taxes.

- Most obviously funding the government

- Economic redistribution (safety net, that we a progressive tax system)

- Economic incentives

This third point is often forgotten in my experience so deserves a bit of explanation.

As an example: Collectively we the people have decided though our elected representatives that certain behaviors should be promoted or discouraged. We promote home ownership with the mortgage interest deduction, we discourage smoking by taxing cigarettes. While one could certainly object to the particular selection of behaviors being promoted and discouraged this is (in my opinion) a necessary government function. As such the tax code will by necessity remain "complex" to allow for this. You will get no argument from me that occasionally revisiting what behaviors are being promoted or discouraged is a good thing.

In my lifetime I don't recall one vote referendum on tax policy, but I recall numerous tax tweaks to "create jobs" or pump up the economy.

Back in the '70s I worked for a business whose sole existence was to package R&D tax shelters to take advantage of a tax law incentive. This business would find some promising invention, get together a bunch of rich doctors and lawyer looking for a tax break, and create a new business entity to develop that new invention. The tax law allowed the investors to deduct several times their initial investment in deductions. This was kind of like that Mel Brooks play "The Producers", where the plan was to lose money, so the wealthy could take unearned tax deductions.

While this was abusive, and congress eventually closed the loopholes that allowed this, all such tax engineering can result in unintended consequences and bad behavior. It is human nature for me to favor tax breaks for small business (like for purchasing new equipment), but frankly I would be much happier to see a simpler tax code, and a lower average rate that collects the same net amount without the loopholes that favor some subset of the larger group..

It is not totally unreasonable to suggest that major changes to our tax system might not get closer to the collective "ideal" tax system but there would be many unintended consequences due to all the new loop holes created by a new system.

Philip

I am opposed to social engineering and one of the top "big lies" from government, is that they can create jobs... Both sides are now making expansive claims about how many jobs they will create if elected/re-elected. Well guess what. If government could create jobs, they sure would have over the last few years... the legislators in office now re-election depends on it.

The best thing that the government can do to help the economy, is to slowly back away, and let business do what businesses do (create wealth). Governments only consume wealth making the economic pie smaller.

Income redistribution seems wrong on several levels, but IMO is also counter productive for growing the entire economy. We need a safety net for the least fortunate among us, but too much government largess (which ultimately must come from productive taxpayers) leads to dependance and is a disincentive against productive employment. I am imposing my personal morality (that people should work for, and earn what they get), but I don't believe that just because my neighbor has more than me, I deserve some of his hard earned wealth. maybe Jay Leno should give me a few of his cars...

IMO tax law should be relatively clean of social engineering and behavioral incentives. Deductions for children seems unfair, since they also place a larger burden on taxpayers for education, but this is generally accepted as on the general interest (it takes more people to support growth, that helps everybody). Western nation's declining populations suggest that even this economic incentive is not enough.

Tax incentives for home ownership, is another apple pie giveaway, and undeniably, it is good for communities to have stable homeowners rather than transient renters, but the current housing bubble that we still haven't recovered from (because the government still hasn't allowed the market to bottom and clear) shows the danger of too much economic incentives to promote a social theme. Congress and regulators leaned on banks to make uneconomic loans, and other regulators looked the other way, or just didn't understand the danger from fannie and freddie providing so much easy credit to the housing market. They satisfied the superficial goal of making more people home owners, but we will still be paying for this debacle for years. And by "we" I mean taxpayers and savers, as the government is still trying to prop up housing with new whore-house deals.

I suspect our tolerance for tax cut-outs depends on whether we feel like we are getting some, and the whole system is engineered with over witholding and an annual refund check to seem less painful. If individuals had to make quarterly tax payments like business, we would have had a tax revoltuion long ago.

Of course this is clearly getting into politics, since the electorate is always looking to elected leaders for solutions, and they are always willing to promise stuff they can never deliver. I suspect a truthful politician would never get elected, so they rationalize they must say that to get in office. It's all a big dance and we will keep getting what we get as long as we willingly play along.

I feel like I'm in 'a' 1%, not top income earners but 1% who can see the situation for what it is..

of course this is arrogant and I could be wrong.

JR

Caveat: My step father (RIP) ran a tax accounting business for years after he retired, but i claim no special expertise in tax law, beyond decades of mostly doing my own tax returns, personal experience, and simple observation.